|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding Rates for a Cash Out Refinance in Today's MarketA cash out refinance allows homeowners to leverage the equity in their home to access funds for various needs. Understanding the rates associated with this financial product is crucial for making informed decisions. What is a Cash Out Refinance?A cash out refinance involves replacing your existing mortgage with a new one, while borrowing more than what you currently owe. The difference is received in cash, which can be used for purposes like home improvements, debt consolidation, or other financial needs. Benefits of a Cash Out Refinance

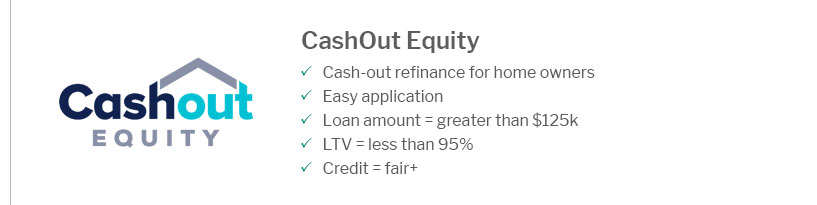

Factors Influencing Cash Out Refinance RatesVarious factors can impact the rates you receive for a cash out refinance. Here's what you should consider: Credit ScoreYour credit score plays a significant role in determining the interest rates available to you. A higher score often results in more favorable terms. Loan-to-Value Ratio (LTV)The amount of equity you have in your home influences your LTV ratio. A lower LTV can lead to better rates. Market ConditionsCurrent market conditions, including the economy and Federal Reserve policies, can affect interest rates. For example, you can compare 20 year home refinance rates to understand broader trends. Steps to Secure the Best Rates

FAQsWhat is the typical interest rate for a cash out refinance?Interest rates for cash out refinances can vary based on credit score, LTV, and market conditions. Typically, they range from 3% to 6%. How much can I borrow with a cash out refinance?The amount you can borrow typically depends on your home equity. Lenders usually allow up to 80% of the home's value, minus what you owe on the existing mortgage. Are there any risks associated with a cash out refinance?Yes, using home equity increases your debt. If property values drop, you may owe more than your home is worth. It's essential to consider long-term financial goals. In conclusion, understanding the factors that affect rates for a cash out refinance can help you make the best financial decision for your situation. By taking steps to improve your credit and comparing different options, you can secure favorable terms and make the most of your home's equity. https://www.lendingtree.com/home/refinance/cash-out/

Refinance closing costs typically range from 2% to 6% of your loan amount, depending on your loan size. You'll pay the same types of fees for a ... https://www.cmgfi.com/refinance/cash-out-refinance

Refinance Calculator - Loan Amount - Term (Yrs) - Interest Rate (%) - Mortgage Ins. (Monthly) - Estimated Settlement Costs. https://www.discover.com/home-loans/refinance/

Mortgage Refinance: Rates, terms, and fees - Interest Rates - Fixed interest rates from 7.00% - 8.55% APR - Loan Amounts - $35,000-$300,000 - Payments - Fixed Monthly ...

|

|---|